Five Experts, Perfectly Aligned with the Three Competition Modules

The Camino Digital Advisors core team consists of five experts with deep backgrounds in quantitative finance, macroeconomics, automation algorithms, and trading technology audit, ensuring the comprehensive and professional execution of our three-layer strategy framework (Market Map, Waypoints, Guardrails).

Álvaro de la Vega Montserrat

(Chief Representative)

- Core Positioning -> Chief Analyst at Camino Digital Advisors, Chief Architect of the strategy system, responsible for final strategy integration, risk balancing, and macro direction setting. He has over 15 years of experience in quantitative risk management at top-tier institutions.

- Role in CXOBE -> Responsible for the final audit of the Market Map and the risk budget setting of Guardrails, ensuring system-level risk does not exceed predetermined thresholds. He will serve as the final methodology defender.

Elena Ruiz

(Quantitative Execution Lead)

- Core Positioning -> The engineering core driving the strategy engine, specializing in using quantitative models to predict short-term market microstructure changes and liquidity risk.

- Role in CXOBE -> Provides algorithm-based Probabilistic Entry Suggestions for Waypoints (e.g., entry range with a success rate greater than 75% under a given risk appetite), and is responsible for the demonstration and tuning of the Emotional Threshold Warning System.

Javier Torres

(Digital Assets Research Director)

- Core Positioning -> Risk Review Officer and Data Translator for the crypto market, focusing on On-Chain Analytics and DeFi liquidity risk assessment.

- Role in CXOBE -> Jointly responsible for the input of the Market Map with Isabel, particularly focusing on unique crypto market risk factors and cross-chain fund flow indicators.

Isabel Gómez

(European Macro and Market Analyst)

- Core Positioning -> Expert in interpreting the European economic cycle, skilled at translating complex central bank monetary policy and geopolitical risks into quantifiable macro risk factor loadings.

- Role in CXOBE -> Responsible for the macro-dimensional input of the Market Map, providing systemic risk warnings regarding major stock indices (IBEX35, S&P500).

Ricardo Martín

(Trading Execution and Audit Technology Expert)

- Core Positioning -> Guardian of the trading process. With extensive experience in low-latency trading systems and post-trade auditing, he is the core technical guarantor of Auditability.

- Role in CXOBE -> Responsible for the technical implementation of Guardrails, ensuring all stop-loss orders and mandatory position reductions are triggered in real-time with millisecond speed, and providing a complete execution log chain.

Ten Regional Elites

The CXOBE Official Trading Championship is the premier venue for showcasing global professional trading methodologies. Besides the Spain Region led by the Camino team, 10 other countries/regions have fielded top representatives with unique strategic advantages. They will compete under the unified CXOBE rules and the three-layer structure (Market Map, Waypoints, Guardrails).

Region | Name | Expertise Focus | CXOBE Strategy Focus |

🇪🇺 EU Region | Dr. Linnea Hoffmann | Quant-Alpha Research Lead (Frankfurt); Regulatory-compliant derivatives quant hedging. | Regulatory Edge: Risk-neutral strategies and capital efficiency optimization under European regulation. |

🇬🇧 UK | Marcus Thorne | Former Global Macro PM (London); Global macro & FX/Commodity linkage modeling. | Liquidity Guard: Systematic macro event trading and risk management for sudden liquidity black holes. |

🇺🇸 USA | Devin Jacobs | HFT Strategy Lead (New York); Market microstructure analysis and systematic signal extraction. | Speed & Signal: Model-driven automated trading, optimizing for millisecond execution efficiency and minimal slippage. |

🇨🇦 Canada | Amara Khan | Statistical Risk Management Expert (Toronto); Bayesian statistics and dynamic optimization under extreme stress. | Adaptive Risk: Market Map based on predicted volatility; Guardrails dynamically adjusts risk budget. |

🇦🇪 UAE | Omar Al-Mansoori | Global Capital Flow Strategist (Dubai); Energy pricing mechanisms and Sovereign Wealth Flow research. | Global Flow Map: Tracking energy and SWF flows to capture macro trend shifts. |

🇸🇬 Singapore | Kenji Tan | APAC Prop Trading Head (Singapore); Cross-exchange/cross-market arbitrage and multi-currency hedging. | Cross-Market Efficiency: Focusing on capturing minor market imbalances in the APAC region for low-risk, stable returns. |

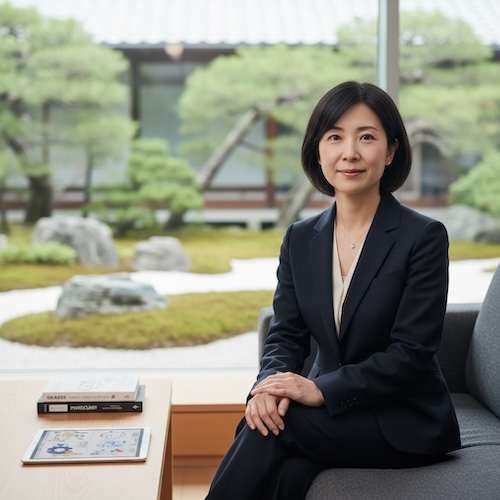

🇯🇵 Japan | Dr. Aiko Sato | Financial Psychology Professor (Tokyo); Behavioral finance and investor emotional bias identification. | Anti-Bias Guard: Mandatory strategy hibernation or contrarian hedging during periods of extreme market sentiment. |

🇰🇷 Korea | Hye-Jin Park | Blockchain & DeFi Strategist (Seoul); On-Chain Data analysis and crypto volatility arbitrage. | Decentralized Waypoints: Waypoints trigger conditions directly integrated with on-chain data (whale movements, TVL, etc.). |

🇧🇷 Brazil | Lucas Silva | Emerging Markets Macro Strategist (São Paulo); Asset allocation and high-volatility hedging in inflationary environments. | Volatility Tamer: Capturing explosive returns from EM volatility while employing extreme hedging protection. |

🇪🇸 Spain | Álvaro de la Vega M. | Chief Analyst at Camino Digital Advisors; Former Wall Street Quant, Structure and Discipline Engineering. | System Integrity: Validating the robustness and replicability of the institutional-grade system as the methodology demonstrator. |